5 Proven Ways to Reduce Churn During SaaS Renewals

A staggering 75% of companies find their customers contemplating alternatives during renewals, significantly impacting revenue and growth.

But there's good news: churn is manageable.

Customers explore alternatives driven by critical needs: cost-cutting in tight financial times, dissatisfaction with current services, and the hunt for innovation missing from their existing providers. Recognizing these motivations is crucial in addressing customer churn effectively.

We're exploring five potent strategies to keep your customers close. These include introducing flexible payment options like Buy Now, Pay Later(BNPL), delivering a personalized customer experience, initiating renewal conversations early, offering attractive early renewal perks, and leveraging precise consumer metrics for deeper insights into customer needs.

These approaches aim not just to curb churn but to elevate customer loyalty and happiness.

Ready to transform your service into their go-to choice?

Let's get started.

Understanding Churn: Why Customers Leave?

It takes a significantly greater amount of resources to acquire customers than to retain them. Hence, understanding why customers may not want to renew their SaaS subscriptions is critical to effectively tackling churn, and here are some reasons why:

1. Budget Constraints

Economic factors or changes in a customer's financial situation are significant drivers of churn. Successful renewals in such cases call for payment flexibility.

2. Lack of Perceived Value

Customer trust dips when they don't see ongoing value in your SaaS, especially if the cost doesn't seem to match the benefits.

The real value lies not just in features or pricing but in how well it helps customers achieve their goals, reflecting the return on investment (ROI) they get.

Keeping subscribers means constantly proving your product's worth and ensuring they see this value in every interaction. This approach ensures customers feel their investment is justified, maintaining their loyalty and trust.

3. Product-User Misfit

Sometimes, the product or its features no longer align with the customer's needs or expectations, leading to churn at renewal time.

Understanding and aligning with customer needs is crucial. Gathering direct feedback through focus groups, surveys, and interviews can guide product development to better meet user requirements, thus improving satisfaction and loyalty and reducing churn.

4. Poor Customer Support

Frictionless customer support is essential in SaaS. With 58% of customers leaving for better support, it’s clear that service goes beyond problem-solving—it’s about delighting customers.

Neglecting the customer journey and focusing only on the product can lead to missed opportunities to enhance user experience, possibly driving customers away. For companies hesitant to invest heavily in a support team, AI-powered chatbots offer a revolutionary solution for enhancing customer support.

5. Competitive Offers

Customers prioritize value for money; superior products alone won’t keep them if a better offer appears.

An offer from a competitor at even a slightly lower price than yours can tip the scales. Advances by rivals, like better customization or user experience, pose additional threats.

To maintain your edge, balance fair pricing with unique benefits. Regularly adjust your strategy to meet customer expectations, minimizing churn and fostering loyalty. Keeping an eye on competitors’ moves and aligning your offerings to meet customer demands is key.

5 Proven Ways to Reduce Churn During SaaS Renewals

Reducing churn isn't just about retention; it's about enhancing your service's value. In a crowded software market, leveraging proven strategies is vital, especially at subscription renewal.

Here are five effective churn reduction strategies for SaaS renewals:

1. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) options effectively address the possibility of churn due to budget constraints. They allow customers, particularly those from small and medium-sized enterprises with limited cash flows, to split the contract value into multiple payments spread quarterly, six-monthly, or as they choose.

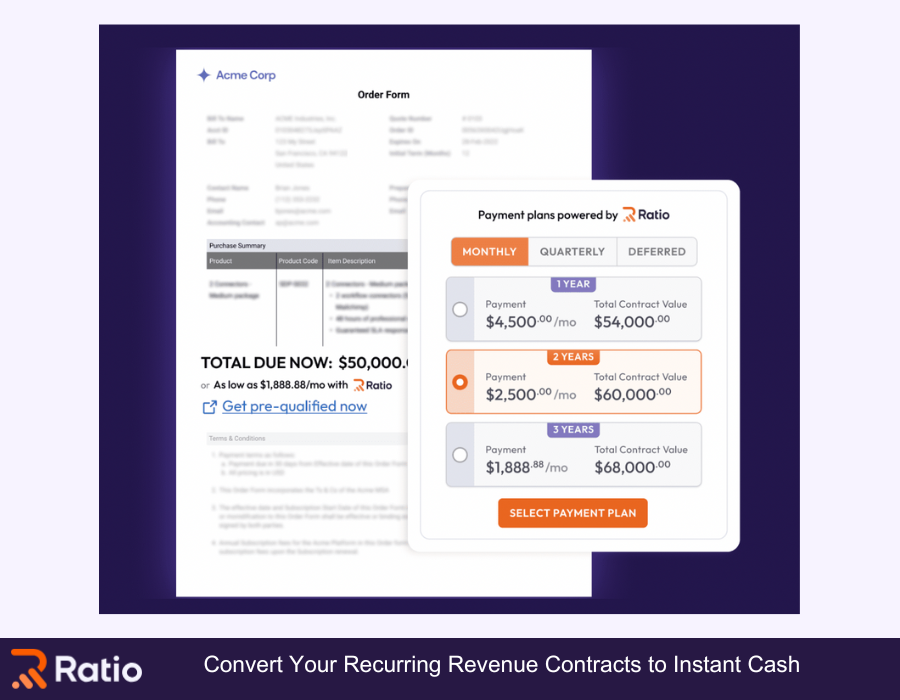

However, this flexibility of payments (read lack of lump sum payments) may restrict access to working capital for SaaS businesses. This calls for financing partners, like Ratio, who ensure that the SaaS company receives the total contract value upfront while Ratio collects payments (due to you) from your customer as per the BNPL arrangement.

Ratio Boost further sweetens the deal by allowing your customers to pick up the BNPL payment terms that align with their specific business setting, as shown below.

This payment flexibility minimizes lost deals due to budget constraints, empowering business buyers.

Backed by an exceptional team with deep expertise in SaaS and finance, Ratio Boost ensures a reliable BNPL solution for SaaS businesses—see how one SaaS provider put it into practice.

With $411 million in funding, Boost brings significant advantages:

- Low Customer Acquisition Costs: Offering BNPL as an alternative to discounts maintains your software's perceived value and lowers acquisition costs.

- More Deal Closures: Flexible payments make customers more inclined to commit, boosting renewal chances.

- Minimizes Lost Deals: Proactively tackling budget constraints, Ratio Boost cuts the risk of losing deals, enhancing acquisition and retention.

- Instant Capital for Vendors: Vendors get upfront payments while offering flexible terms to customers, ensuring steady cash flow.

2. Personalized Customer Experience

McKinsey reports that 71% of customers prefer personalized interactions, and 76% are dissatisfied when it's missing. This underlines the importance of adapting SaaS products to individual preferences, significantly affecting retention and loyalty.

Tailoring experiences using user data can enhance engagement and decrease churn.

A straightforward onboarding process, including easy sign-up, interactive guides, and immediate support, helps users quickly realize the product's value. However, dedicated guidance is vital for more complex offerings.

Additionally, proactive support is crucial, with 90% of customers expecting quick assistance. This rapid response not only solves issues faster but also reinforces the user's service choice.

Personalization, streamlined onboarding, and anticipatory support are vital in SaaS strategies to reduce churn, make customers feel valued, and foster loyalty.

Also Read: How SaaS companies can sell more?

3. Proactive Renewal Reminders

SaaS businesses risk losing revenue and damaging retention efforts if customers fail to renew subscriptions, often due to payment issues like expired credit cards. About 50% of customers will need to update their payment info, risking involuntary churn.

To tackle this, SaaS companies need a strategy that includes:

- Combined Communication Efforts: Employ proactive reminders and crafted emails to inform customers about expiring cards and payment failures, providing easy update links.

- In-app Engagement: Use in-app notifications with email alerts, offering a grace period for updates to avoid service interruptions.

- Subscription Management: Promote auto-renewal benefits and send annual reminders for hassle-free subscription maintenance.

This approach reduces churn, improves the user experience, and strengthens retention by underscoring the product’s value to its users.

4. Offer Incentives for SaaS Renewals

SaaS businesses should leverage well-timed incentives such as discounts, reactivated trials, grace periods, and bundle deals to maintain customer relationships and reduce churn. Incentives can tip the scales in your favor.

Timing and aligning incentives with customer needs are crucial. Offering discounts near the end of contracts or in response to specific feedback can persuade customers to renew. Namecheap, for instance, provides enticing offers for domain, hosting, and SSL certificate renewals, including a notable 20% discount on renewals and a 33% discount on new.com domain registrations.

This not only provides immediate value to the customer but also establishes Namecheap as a partner in saving, which can be a strong incentive for renewal.

Strategically timing incentives based on customer needs significantly reduces churn and improves satisfaction.

5. Develop Effective Consumer Metrics

Utilize consumer behavior data and analytics to uncover customer satisfaction and loyalty metrics, guiding targeted engagement and retention strategies. Effective tactics include:

- Analyzing interactions, purchase history, and feedback to map customer engagement and drop-off points. Tools like HotJar shed light on behavior patterns.

- Using historical data to forecast which customers might churn, tailoring proactive retention efforts for the 90% who value preference-aware brands.

- Segmenting customers by demographics and behavior to customize loyalty programs, rewarding ongoing patronage.

- Emphasizing excellent customer service is crucial for the 77% of consumers loyal to brands with superior support. Maintain a feedback loop for continuous product or service enhancement based on customer input.

Despite 80% of businesses believing they deliver standout customer experiences, only 8% of customers agree. Close this gap with regular surveys and open feedback channels, improving prediction and reducing churn.

Also Read: 7 Innovative Approaches and Common Pitfalls to Avoid for Your B2B SaaS

Reducing Renewal Churn: How Can Your SaaS Stay Ahead of the Curve?

SaaS startups are grappling with a critical issue: a 60% revenue churn due to pricing challenges.

Ratio Boost offers a crucial solution with its Buy Now, Pay Later (BNPL) service, effectively addressing budget-related concerns of customers during renewals. Ratio Boost not only enables you to give customers the flexibility they crave but also ensures you get paid upfront. It eliminates the need for discounts to seal deals and eases cash flow worries.

But there’s more to Ratio Boost than meets the eye:

- Ratio takes on the underwriting risk, sparing SaaS entrepreneurs from personal guarantees.

- Boost seamlessly fits into sales processes, making BNPL transactions smooth.

- Ratio delivers swift approvals, often within 48 hours, with funds landing in your account in just a couple of weeks.

- Ratio Boost handles payment reminders, lightening the load for finance teams.

- Ratio app is super easy to use; you can reduce churn and accelerate revenue in five steps—and our FAQs cover common setup, underwriting, and payout questions.

Don't wait: Sign up on the Ratio app today and start reducing churn.

.png)